The Prism

Options Review

If you have reached a crossroads with your business and are unsure which direction to go, then we will provide an invaluable, experienced, external perspective on your business alongside commercial insight, valuation and recommendations for the best route to take.

PART 1:

DETAILED ANALYSIS

► Thorough business review.

► Personal needs and goals.

► Competition and market.

PART 2:

ASSESSMENT

► All potential future optis.

► Consideration of timing.

► Current market valuation.

PART 3:

RECOMENDATIONS

► The best option(s).

► Aspects to focus on.

► Roadmap for future.

PART 1:

DETAILED ANALYSIS

► Thorough business review.

► Personal needs and goals.

► Competition and market.

PART 2:

ASSESSMENT

► All potential future options.

► Consideration of timing.

► Current market valuation.

PART 3:

RECOMENDATIONS

► The best option(s).

► Aspects to focus on.

► Roadmap for the future.

The Prism team have been supporting clients through their M&A journeys for 20 years and are experts in the tech sector. We use our extensive experience and industry knowledge to identify the best direction to take your business.

It all starts with a free, confidential and no obligation 1-to-1 Chat with a Prism director to discuss your next steps and what we might be able to do to help you achieve your business and personal goals.

Options Review

The Prism Options Review provides an invaluable external perspective of your business, allowing you to understand and compare alternative strategies with realistic numbers attached. As well as evaluating your business, it explores your personal motivations, provides a market valuation of your business, and highlights aspects that can be improved to make your business better and more valuable.

Part 1: Detailed Analysis

- Thorough business review – a deep dive into all operational aspects including products & services (eg. technology & IP), customer composition & relationships, sales & marketing, management & personnel, systems & processes etc.

- Financial performance – both historic and forecast.

- Your personal needs and goals – we consider your own objectives, motivations, aspirations and timing.

- Competition and market dynamics.

- Recent M&A activity in your specific sector.

Part 2: Assessment

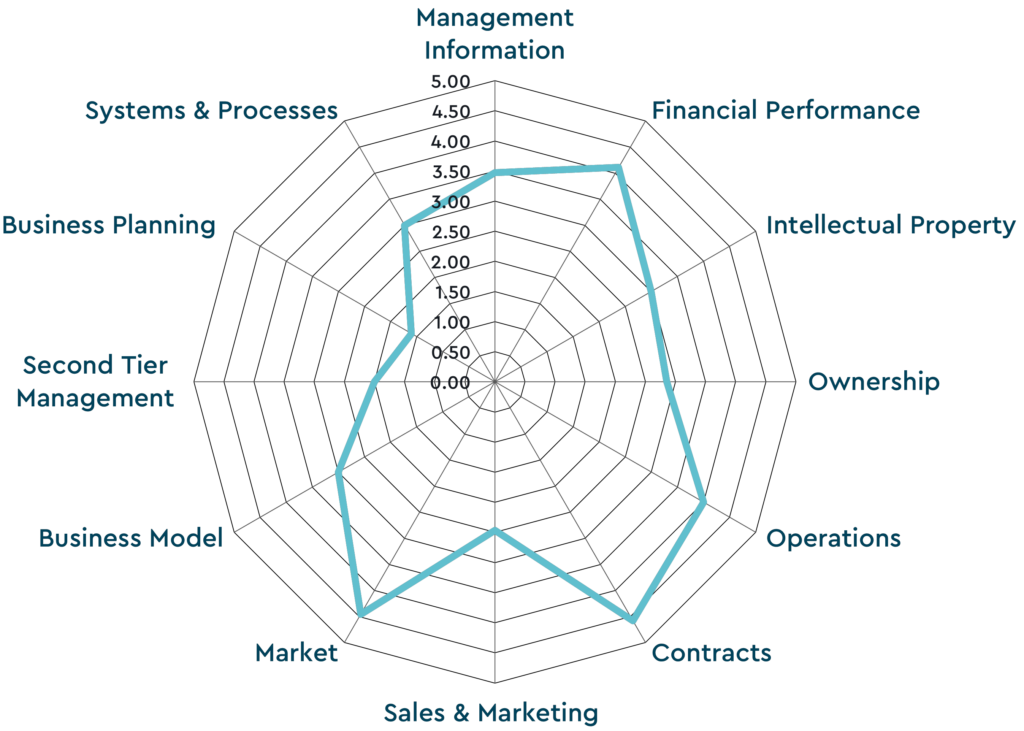

- Operational aspects rated – we indicate how key parts of the business are performing.

- All potential future options – we explore possible routes such as carrying on running the business, selling, transferring to family, employee ownership, management buy-out, acquisition and merging.

- Saleability and value – including both positive and negative factors that affect them.

- Exit readiness – including dependencies.

- Likely current market valuation.

- Options that best meet your personal objectives.

- Considerations on timing.

The Prism Options Review Spidergram shows the results of our operational deep dive with each aspect rated out of 5 as to how well we think it is performing. For the lowest rated we provide steps you can take to make improvements.

Part 3: Recommendations

- The best option(s) – which route we recommend to best achieve your personal and business goals and why.

- Aspects to focus on – the parts of your business you should focus your efforts on to make it better and more valuable.

- Clear guidance on the timing of any sale/exit route.

- Roadmap for the future – directions on how to succeed with the chosen option(s).

To discuss your thoughts and goals and to find out if an Options Review is right for you, book a 1-to-1 Chat directly by choosing your preferred meeting slot in a Prism Director’s calendar: